What is SJKP?

Skim Jaminan Kredit Perumahan (SJKP) also known as the Housing Credit Guarantee Scheme (HCGS) is a financial assistance scheme that aims to help Malaysian citizens without a fixed income to purchase their first home.

If you are a small business owner, gig worker or freelancer, SJKP might be the home financing option for you.

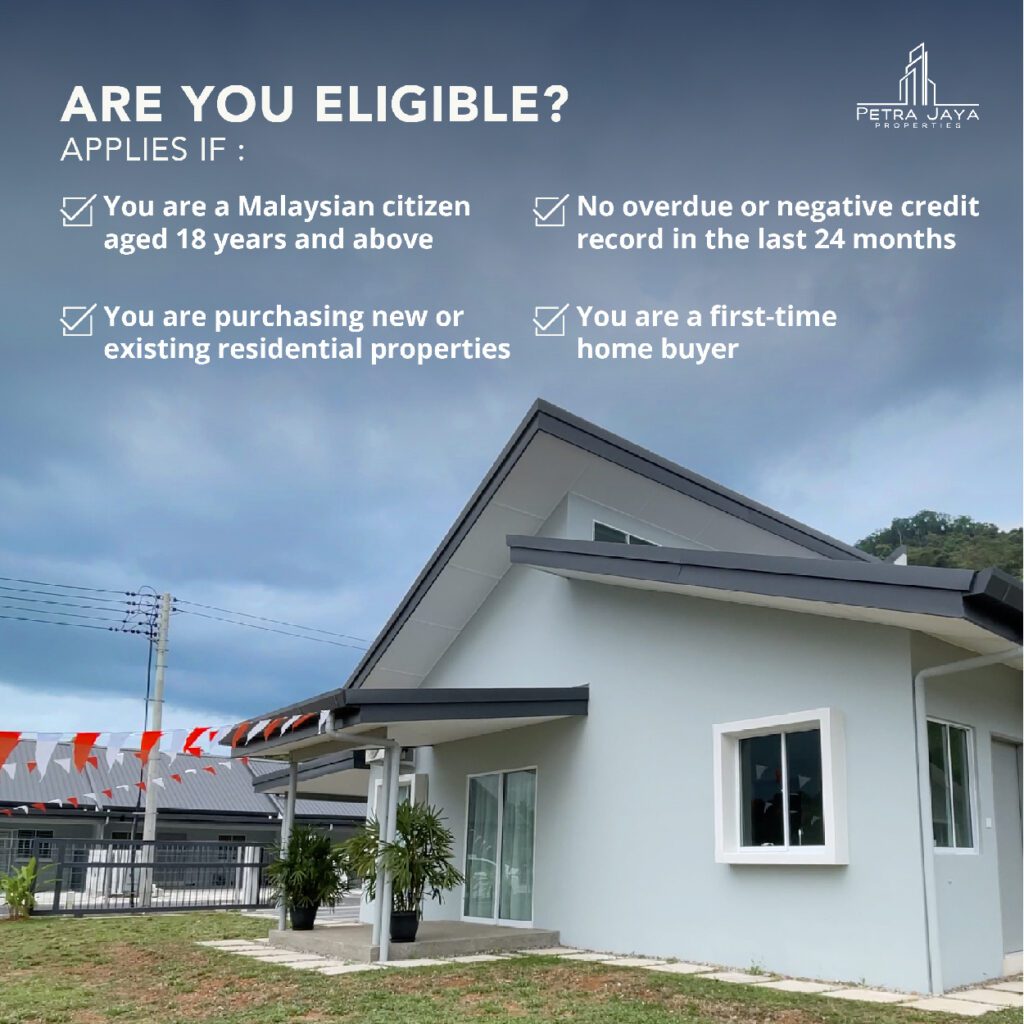

Who is Eligible to Apply?

Financing Margin |

Up to 100% financing for homes up to RM500,000 (including MRTA/MRTT).

Up to 110% financing for homes up to RM300,000 (including the principal financing amount, legal fees, valuation fees, insurance, furniture purchase, and renovation costs).

Financing Margin |

Up to 100% financing for homes up to RM500,000 (including MRTA/MRTT).

Up to 110% financing for homes up to RM300,000 (including the principal financing amount, legal fees, valuation fees, insurance, furniture purchase, and renovation costs).

Financing Type

Valid for term financing only.

Financing Type

Valid for term financing only.

Financing Period

Up to 35 years, or; Up to the financing period, two-generation loans are allowed.

Financing Period

Up to 35 years, or; Up to the financing period, two-generation loans are allowed.

Financing Guarantee

100% guarantee on the financing amount, including the principal financing amount, MRTA/MRTT, LTHO, legal fees, and valuation fees.

Financing Guarantee

100% guarantee on the financing amount, including the principal financing amount, MRTA/MRTT, LTHO, legal fees, and valuation fees.

Financing Limit

Up to RM500,000, including the principal financing amount, MRTA/MRTT, LTHO, legal fees, and valuation fees.

Financing Limit

Up to RM500,000, including the principal financing amount, MRTA/MRTT, LTHO, legal fees, and valuation fees.

Interest Rate

As determined by the participating bank based on standard base rates and loan rates.

Interest Rate

As determined by the participating bank based on standard base rates and loan rates.

Deposit

Mandatory deposit equivalent to 3 months of the initial payment.

Deposit

Mandatory deposit equivalent to 3 months of the initial payment.

How to Apply?

- Obtain relevant housing documents such as the draft of the sales and purchase agreement or the receipt of the booking payment.

- Obtain income confirmation letters from authorized parties such as Category A Government Officers, Head of Village and Safety Committees (JKKK), Chiefs, or elected representatives.

- The letter must include names, identification numbers, sources of income, average monthly income, business location, and business duration.

- Husbands and wives with separate incomes need to obtain two confirmation letters.

- Bring your salary slip and Employees Provident Fund (EPF) statement if you are a salaried employee.

- Prepare supporting documents for income sources, such as savings account statements, Business Licenses, Fishermen Registration Cards, or land title deeds (for farming activities), or other sales and purchase documents.

- Take all the mentioned documents to any branch of a financial institution participating in the Home Financing Guarantee Scheme (SJKP) for application, such as SJKP Bank Rakyat or SJKP BSN.

Note that applications for SJKP can only be made physically at selected financial institutions.

Participating Financial Institutions

Want to Know More? Let Us Help!

You may visit the official LPPSA website to know more. Alternatively, you may also speak to our sales team and they will assist you in finding the right financing options for your new home!

WhatsApp: 012 322 8860

Hotline: 082 288 860